Extreme Heat and Record-Low Soil Moisture Levels Driving Down Brazil Soybean Production

Brazil’s soybean production for the 2024/25 season has declined, primarily driven by extreme heat and record-low soil moisture levels causing widespread dryness across key soybean-producing regions. Lower-than-forecast rainfall has further intensified these conditions, particularly impacting the Rio Grande do Sul region, which accounts for the largest share of the production decline compared to Conab’s estimates.

Key Drivers Impacting Soybean Production

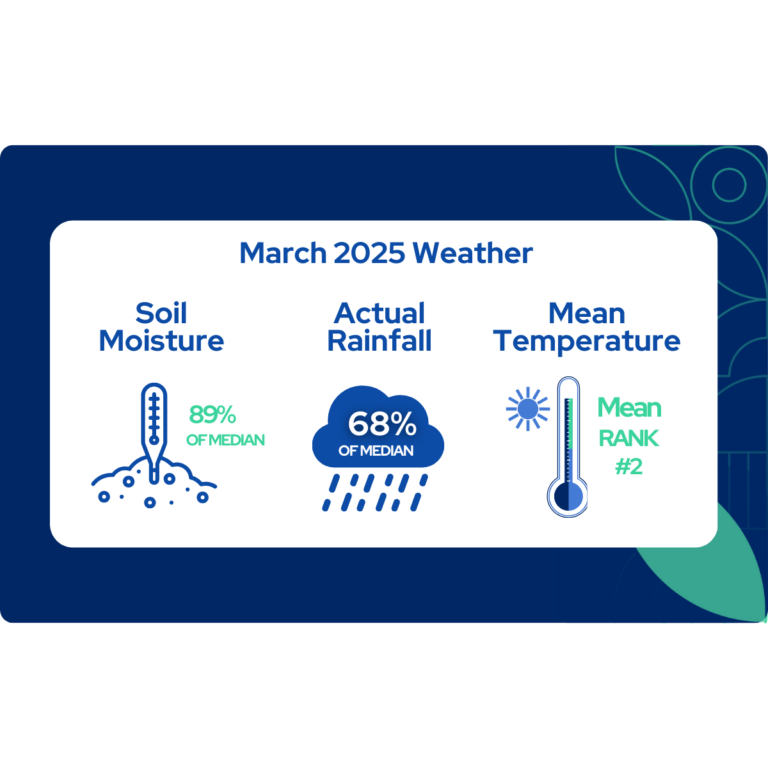

The decline in Brazil’s soybean production is driven by these significant weather factors:

- Precipitation: Rainfall was significantly lower than forecast, with the actual rainfall reaching 68% of the median, compared to 90% of the median forecasted.

- Temperature: Temperatures in March 2024 were among the hottest in recent history, ranking 2nd highest over the past 26 years.

- Soil Moisture: Soil moisture levels dropped to the lowest in 26 years, falling from the 22nd to the 26th driest ranking.

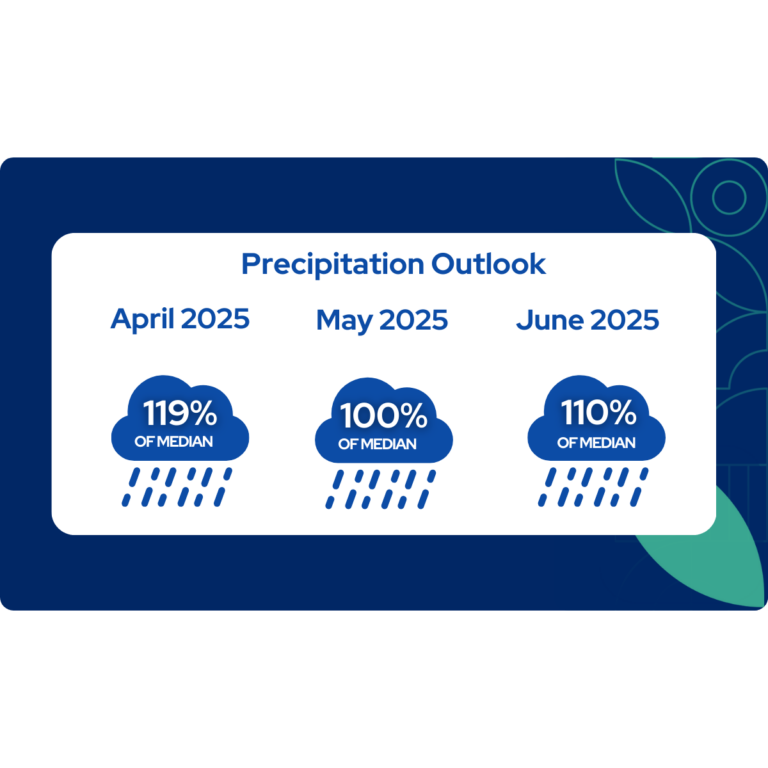

Seasonal Outlook: Mixed Regional Forecast

The precipitation outlook from April to June 2025 indicates overall improved rainfall conditions, averaging around 110% of the median across Brazil’s soybean-producing regions.

The outlook varies significantly between regions, with Bahia and Piauí forecasted to receive exceptionally high rainfall while Santa Catarina and Paraná are forecasted to receive below-median rainfall during this period.

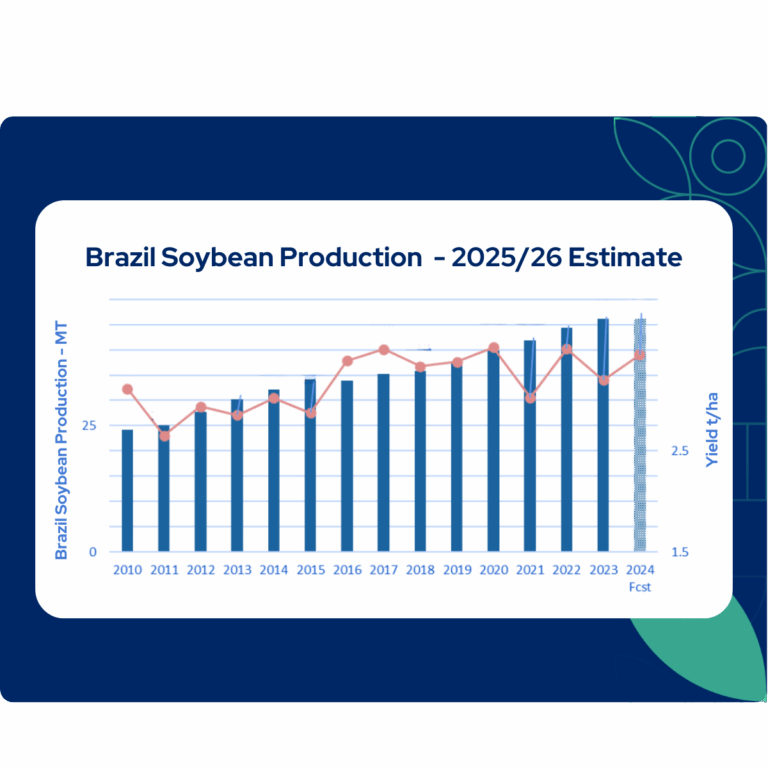

Impact on Soybean Yields

Brazil’s soybean yields for the 2024/25 season are projected increase but remain lower than Conab’s estimates and the five-year average. The combined effects of lower-than-forecast precipitation, record-low soil moisture levels, and extreme heat in March 2024 have weighed heavily on limiting yield outcomes.

The largest yield losses are observed in Rio Grande do Sul, followed by Mato Grosso and Paraná. However, the improved precipitation outlook from April to June 2025 may provide some relief and limit further yield losses.

Brazil’s Soybean Exports to China Surge Amid Global Trade Shifts

China’s heavy tariffs on all U.S. imports have triggered a major shake-up in global trade. The move severely impacted U.S. agricultural exports with soybean trade taking the hardest hit. In response, China has pivoted almost entirely to Brazilian suppliers, making Brazil the clear winner of this trade shift. This surge in demand has pushed Brazil’s soybean exports to record highs, firmly cementing its position as China’s dominant soybean supplier.

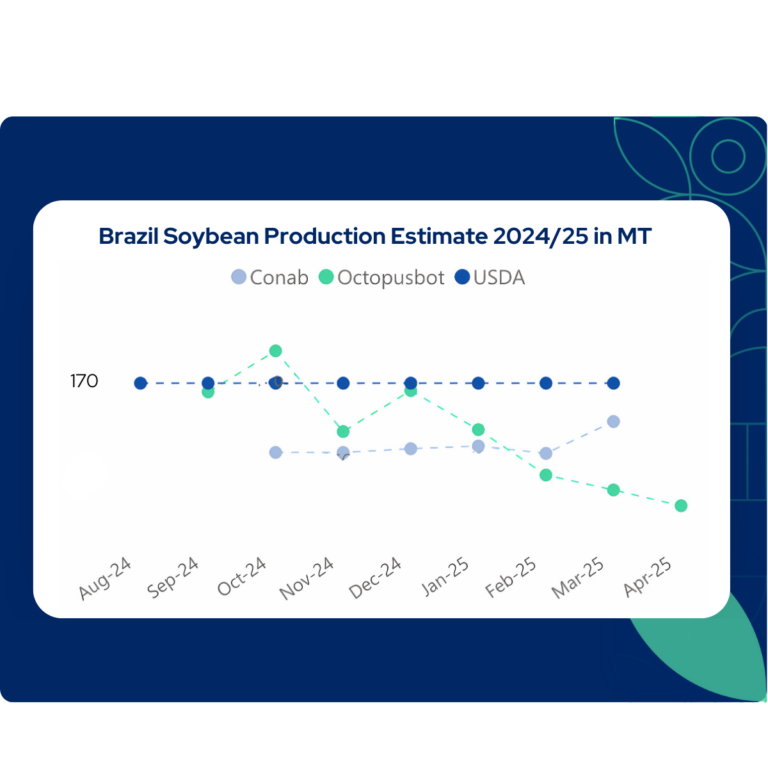

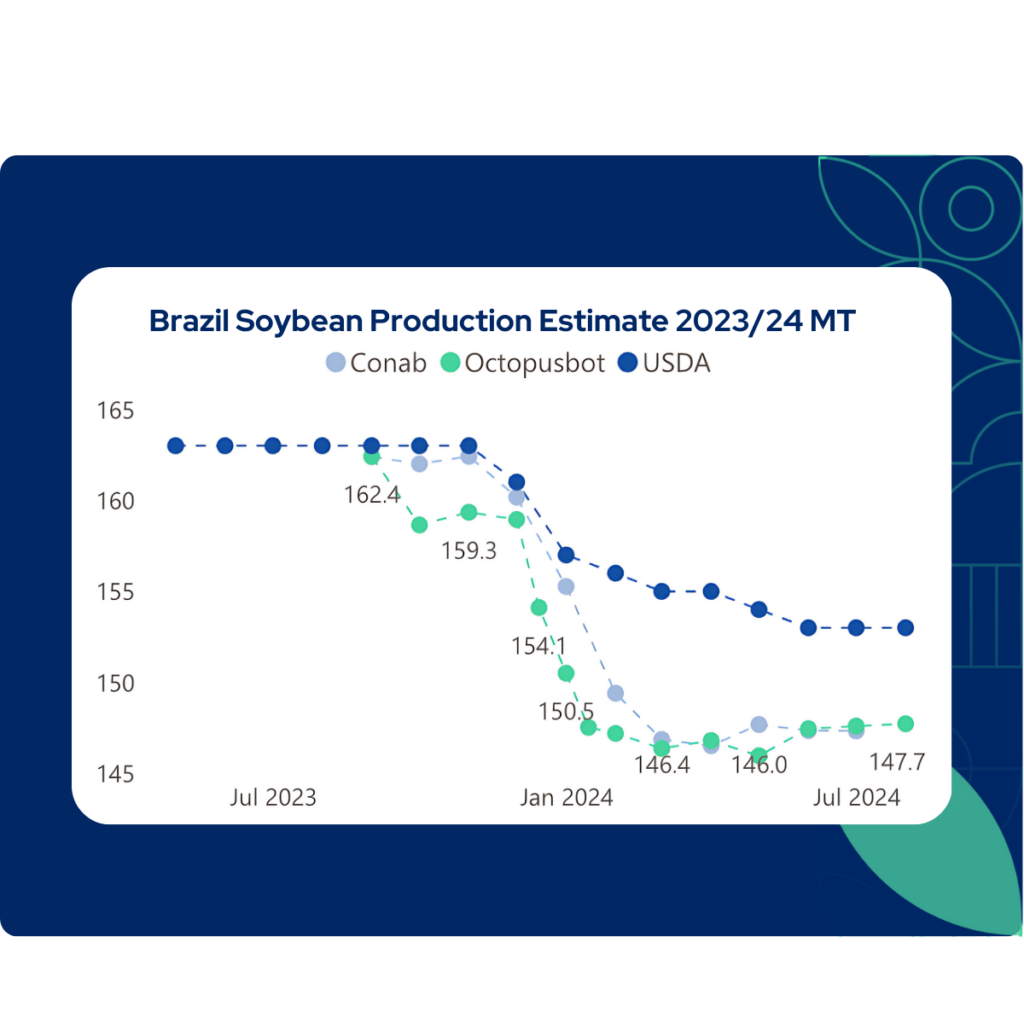

Octopusbot’s Forecast Accuracy

Getting a clear forecast on production early in the season can make all the difference, especially in a year shaped by extreme weather.

In December 2023, Octopusbot predicted the season’s production trend within 95% accuracy range, 8 months before the final estimate and 2 months before Conab’s estimates, with a difference of 0.3% on the final estimate.

Comments are closed